If you have not studied the world of finance, you may choose investment options (from a checklist provided by your human resources office) that lead you down the road to retirement ruin. Be very wary of so-called “safe” investments that really aren’t investments at all. Always keep in mind that an investment grows your money beyond the rate of inflation. If something doesn’t do that, then it is just a cookie jar with a different name.

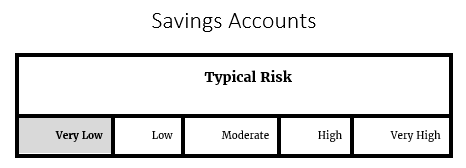

Savings Accounts

Savings accounts are an American institution. Most of us were taught from a tender age that responsible folks have money tucked away in a savings account. It is as if savings were a goal in and of itself, independent of any goal. Ultimately, you want money to buy stuff. If you want to make sure you can keep buying stuff when you are no longer working at some future date, then you must invest. Another goal of saving is to deal with unexpected expenses that arise. Such a fund is often called a “rainy day fund” or an “emergency fund.” I prefer “emergency fund” because it may give you pause before you raid it for something that isn’t an emergency.

Depositing money into a high-yielding savings account at a bank or credit union provides a stable return with almost no investment risk. Risk-averse Investors can take assurance knowing that government agencies, such as the Federal Deposit Insurance Corp. (FDIC) and the National Credit Union Administration (NCUA) partially insure funds held in savings accounts. The downside of keeping money in a savings account is the return. Most high yielding savings accounts provide a lower return than most other investments. Investors are also subject to interest rate risk. For example, if interest rates fall, investors receive less interest on their savings.

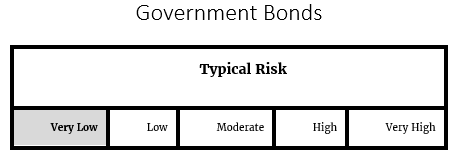

Government Bonds

Government bonds can be lucrative for investors, but only during rare periods of exceptionally high-interest rates. Most investors that hold bonds do so because they are perceived as safe investments. Since they come with the risk of underperforming, they are not risk-free in the long-term sense of the term. Granted, they do tend to exhibit very low volatility, so they are present in nearly every portfolio designed according to Modern Portfolio Theory. Note that bonds issued by the United States tend to be very safe in practice, some municipal bonds may not safe at all. Cities and other governments have declared bankruptcy in the past, and it may not be wise to hold such bonds outside of a fund of such bonds that diversifies away most of the default risk.

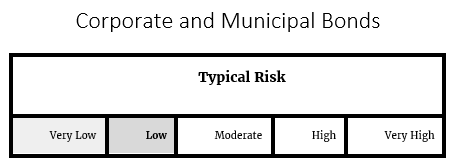

Corporate and Municipal Bonds

Risk-averse investors may want to invest in corporate or municipal bonds. These debt instruments pay a steady dividend to investors. Established companies issue corporate bonds, while state or local governments issue municipal bonds. Risk-averse investors may prefer municipal bonds as they have more financial stability than corporate bonds. However, corporate bonds are still safer than investing in common stocks, because even if the issuing company becomes insolvent, bond investors receive the first payment of leftover money after the company’s creditors. Municipal bonds may also offer superior returns to investments with similar risk, as they are exempt from federal and state tax.

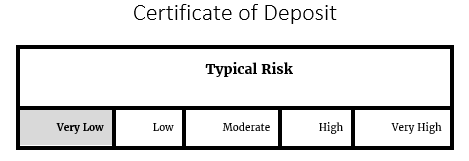

Certificate of Deposit

Risk-averse investors who don’t need to access their money immediately could place it in a certificate of deposit. CDs typically return slightly more than savings accounts, however, to receive higher interest rates, investors need to lock their money away for longer periods and may be charged a withdrawal fee if they want to exit early. For example, a five-year CD may earn 2%, while a one-year CD may offer an interest rate of .75%. CDs are particularly useful for risk-averse investors who are trying to diversify the cash portion of their portfolio.

Risk-averse investors who don’t need to access their money immediately could place it in a certificate of deposit. CDs typically return slightly more than savings accounts, however, to receive higher interest rates, investors need to lock their money away for longer periods and may be charged a withdrawal fee if they want to exit early. For example, a five-year CD may earn 2%, while a one-year CD may offer an interest rate of .75%. CDs are particularly useful for risk-averse investors who are trying to diversify the cash portion of their portfolio.

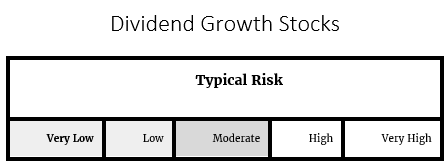

Dividend Growth Stocks

Dividend growth stocks appeal to risk-averse investors because even if a stock’s price falls, predictable dividend payments help offset losses. Companies that increase their annual dividend each year typically do not show the same volatility as stocks purchased for capital appreciation. Stocks in defensive sectors, such as utilities and consumer staples usually show continued dividend growth as these companies can consistently make money in most economic environments. Investors may also have the option to reinvest dividends to buy more shares.

Last Updated: 6/25/2018