SECTION 5.2: How to Budget

It isn’t usually very difficult to figure out your “disposable income” because that’s what gets deposited into the bank every pay period. For the remainder of this book, we’ll lump together all of the income from all earners into a single number. Different family arrangements suit different people, so this may not be a good fit and you may need to develop a more complex budget for your situation. My advice is to always keep things as simple as possible, so long as the simplicity doesn’t hurt your household’s bottom line. I further suggest that each earner have a separate bank account, and then have a joint bill paying account. Each earner deposits a percentage—you can use automatic transfers for this—a predetermined percentage of his/her earnings into the bill pay account each pay period. A single account with two ATM cards and two checkbooks is a recipe for disaster! Everybody needs a little mad money (we’ll define that later!), and a personal account is a great way to deal with those frequent but small expenses that we all incur.

Now that we have determined how much money gets added to the pot every month, we need to figure out how much money is leaving it. All of the money leaving the pot every month can be calculated by adding all of your regular expenses to your irregular expenses. Your regular expenses can be calculated by adding up all of the stuff that you pay every month. These include things like your rent or mortgage, electric bill, gas bill, water bill, cable bill, phone bill, groceries, child care expenses, transportation, and so forth. Add these to your spreadsheet.

Next, you’ll need to and assess your irregular expenses. These are things you pay quarterly, twice per year, or once per year. These can include things like car insurance, homeowner’s or renter’s insurance, flood insurance, property taxes, tuition, and so forth. All of those irregular expenses can be added together and divided by twelve to determine your monthly irregular expenses. To calculate your total expenses, just add your regular monthly expenses and your irregular monthly expenses together.

Your Savings

If you ever want to stop living paycheck to paycheck (or going deeper into debt) you have to have savings. You can figure out how much you are saving by taking your total disposable income and subtracting your total monthly expenses from it. If that number isn’t a positive amount, then you have to immediately make changes. You aren’t living within your means, and financial disaster is looming on the horizon. If you are saving money, you can easily calculate your savings rate by dividing your monthly savings by your total gross income (financial folks use gross income to talk about savings).

Once you see what your savings rate is, you can start to ask yourself if it is enough to achieve your long-term financial goals. If you plan on getting rich, then that number needs to be greater than 10%.

Prioritizing and Budgeting

Let’s back up and revisit the budget spreadsheet idea. For things that are fixed dollar amounts, the spreadsheet is very easy to construct (AT&T Cell Service = $49.99 / month). Most of the irregular expenses can be very closely estimated. But what about things like groceries, entertainment, gifts, and so forth that change every month? That is where discipline and reason come into the budgeting process and emotionality needs to be removed. For these unfixed expenses, you have to fix them! That is, you have to set a budget for that category and stick to it. That is the secret to living within a budget and saving.

To do that sort of disciplined spending, you may have to establish priorities. Your mortgage has to be a top priority. You need a place to live. If you haven’t already got a mortgage, the budgeting process can be an excellent way to determine what you can actually afford! The number that the bank gives you (what they are willing to loan you) is almost always way higher than what you can actually afford without some other area of your life suffering the consequences. Base the home price you are willing to pay on your income, not emotional factors and luxury considerations. If you are renting (almost always a waste of money), then the same rule applies. Do a budget based on a percentage of your disposable income, and then stick to it.

Savings Accounts

Savings accounts pay interest. The amount of interest they pay depends on interest rates. At the current interest rate, you are about as well off putting your money in a coffee can and burying it out behind the woodpile like Crazy Uncle Ernie. Still, there may be a psychological reason to use a savings account. If you are prone to spend money and can attach a psychological resistance to spending money in a savings account, then, by all means, keep your emergency fund in savings. The idea is to create a psychological barrier to spending the money but maintaining easy access in case an emergency does arise. Once the savings reach your emergency fund threshold, then move it somewhere where it can really earn you some interest. Savings accounts are among the worst places possible to save money. A lot of confusion arises about this because, back in the day when interest rates were high, savings accounts were a decent intermediate place to keep money. Not anymore. Grandma got this one wrong.

Your Fun Fund

Life should be enjoyed. We sometimes make sacrifices, sometimes these are for the greater good, but sometimes they are so we can have more fun later. I don’t suggest that you give up everything fun in order to save money and get rich. What I suggest is that you spend wisely on fun and keep that spending within your means and consistent with your financial goals and objectives. One of the best ways to do this is to establish a fun fund.

A fun fund is really just a portion of your monthly budget set aside for entertainment, vacations, and your habits. This is money that you don’t have to spend on the necessities of life, but life sure would be boring if you didn’t spend it. The big question you have to ask yourself is this: Will you feel good about spending the money a month of a year after you’ve spent it?

My recommendation is that you allocate 10% of your income to your fun fund. If you stick to that, you can always move money you don’t spend on fun to another account later if you want to be a more prudent money manager. But without a fun fund, life will be boring and stressful. You have to be honest about which budget you are taking things out of. For example, treating yourself to a wonderful dinner at the best steakhouse in town is entertainment (and comes out of the fun fund) and shouldn’t come out of your grocery budget. You also have to budget entertainment because this is the space where you are very likely to $20 yourself to death! Keeping records may be the hardest part. You can spend an extraordinary amount of money going to movies, renting movies, buying books, graphic novels, and other silent wealth killers.

I’m going to make this harder by adding your television package to your entertainment budget. I once realized that my satellite TV bill was over $200 per month because of all the “6 months free when you sign up” garbage that I hadn’t bothered to take off when the free period expired. That’s why companies give you free trials of things! They know that most people don’t keep up with things like they should and they’ll shell out an incredible amount of money without even thinking about it. I’m a big fan of telling you to constantly reevaluate your financial situation; this goes for entertainment too! Am I getting my payment in value from my cell phone? My television package? My magazine subscriptions? Do I subscribe to services I do not use? Do I subscribe to overlapping services that cost extra every month and don’t add value?

Perhaps the biggest waste of money in the budget of most American’s is eating out. In our modern agricultural system, commodity foods are extremely cheap. We pay a super high premium to “eat out,” on a regular basis, and most of us don’t even realize it. Aside from spending way too much money, we are also very unhealthy because of it. Learn to cook healthy meals at home and you can save an amazing amount of money. To get an idea of how much money we waste on premium food and drinks, look at the revenues of Starbucks! My advice? Quit buying their coffee and spend what you would have spent on coffee on Starbucks stock! I drink a lot of coffee, and I have a coffee shop at work. I could easily spend several hundred dollars per month on what is admittedly good coffee. A long time ago, I realized that it was more convenient and amazingly cheaper to keep a coffee pot in my office (at the risk of offending those few folks that don’t like the smell of coffee.

It is important to realize that when something is convenient, it usually means you’ve paid someone else to do something for you. Convenience food is more expensive than buying raw ingredients and cooking for yourself. Fast food is very convenient, but you are paying a premium for the convenience of having someone else prepare it for you. If you go to a sit-down restaurant with tablecloths, the service is better and the atmosphere is nice. You pay a premium for service and a nice atmosphere! Convenience stores even have the word in the name. Keep up with how much you spend at convenience stores every month, excluding fuel. If you have a car, you have to stop for gas. I frequently grab a soft drink and a snack for a total of about $5. For $3.00, I can catch my favorite soft drinks on sale at the local Dollar Store. My main point is that trivial spending that you thoughtlessly do frequently add up to big money at the end of the year.

Vice

Your health teacher probably told you a long time ago that alcohol, drugs, and tobacco are harmful to your health. We’ve become a little more advanced since then, and there is some evidence that a glass of wine every once in a while may be good for you. I’m not here to preach, I’m here to make you money. From the financial perspective, using tobacco is about as stupid as it gets. I’m excluding the few of us that can have a cigar every couple of weeks with a nice glass of Scotch and let that be it until the next time.

Medical folks may disagree, but the health detriment of a single cigar on a monthly basis seems negligible to me. You may have to budget $20 for a decent cigar every month, but as long as its budgeted I will not chastise you. Smoking a pack a day, however, is unacceptable! It is a colossal waste of money. The average cost of a pack of cigarettes in the United States today is around $5.50. That amounts to a little over $2,000 per year to take five years off of your lifespan. Spouse smoke as well? Add on another $2,000. If you and your spouse smoke two packs per day each, that’s around $8,000 per year just on cigarettes!

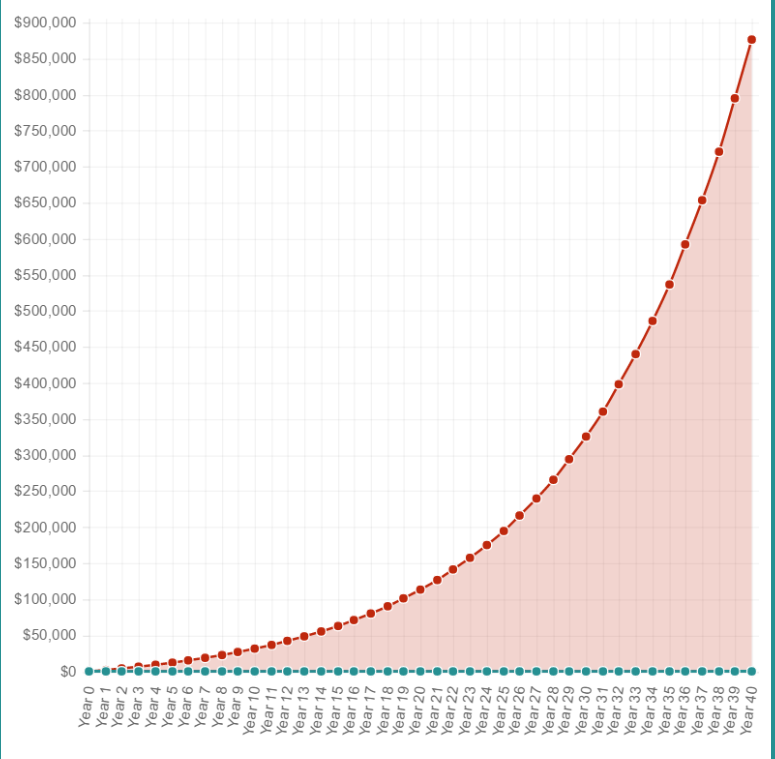

Still, haven’t convinced you to quit? Look at what investing your pack a day habit in the stock market at 10% looks like after 40 years in Figure 4. You’d have nearly a million extra dollars! Regular drinking comes at a high cost as well. The cost of this will depend on what you drink, how often you drink, and how much you drink. Keep a running tally of what you are spending on alcohol and budget that in your fun fund. If you are a regular drinker of high volumes, it will no doubt save you a lot of money to curb your appetites!

Obviously, using illegal drugs can have terrible consequences. Anything bought on the black market is expensive because you are paying the supply chain a risk premium. Also, consider the risks to your health and reputation. Illegal drug use can also have a huge impact on your career, especially if you are a helping professional working for a government agency. A history of drug use can prevent you from getting jobs in your field, making your degree useless. Talk about a loss on your investment! If you are still in college, keep in mind that many agencies make you take a polygraph about your drug use going back many years. The social climate for marijuana may be changing in the United States, but don’t risk the consequences if you want to be a helping professional.

Figure 4: Pack / Day Price Invested Monthly at 10% for 40 years.

[Back |Table of Contents | Next ]