It has often been said that “the market loves certainty.” Most investors (excluding those who seek to capitalize on volatility)…

Month: September 2018

Demystifying Market Corrections

When the market starts trending down, many investors tend to panic. They see volatility as dangerous and formulate a belief…

Demystifying Market Sectors

With all of the hoopla over various stock indices, it is sometimes easy to forget that the stock market is…

Demystifying Price Targets

One of the most important predictors of short-term stock prices is the backing of market analysts in the form of…

Demystifying the Financials Sector

Stock market analysts often worry about market volatility, which is jargon for a rapid cycling of upward and downward trends…

Demystifying the Oil and Gas Sector

As with most of the industries and sectors that stock investors may seek to invest in, the oil and gas…

Demystifying “You Can’t Beat the Market”

As you know, economists are scientific types that study how money flows and grows. They study many different aspects of…

What’s Wrong with My Savings Account?

For the sake of argument, let’s say you have $1000 in your bank savings account. Let’s further assume that your…

Securities to Buy Ahead of an Economic Downturn

A growing list of prestigious individuals and financial houses are telling investors that a downturn is coming. The market is…

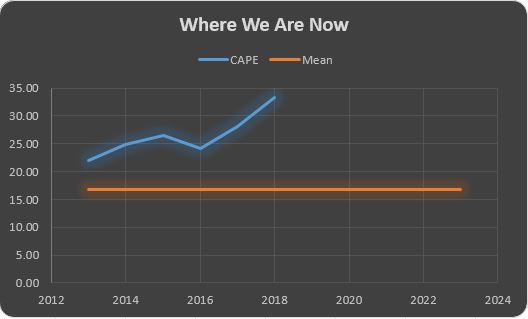

Is the Exuberance Irrational?

A guest on CNBC’s Power Lunch today (09/18/2018) argued that this phase of the bull market is different than similar…